Contributed by Steve Johnson, retired Extension Farm Management Field Specialist

The decision to purchase Supplemental Coverage Option (SCO) crop insurance in 2020 must be confirmed with your crop insurance agent on or before March 15, 2020. This deadline for making crop insurance changes for spring planted crops now becomes the same deadline for electing and enrolling annually in the ARC/PLC program at your local USDA Farm Service Agency (FSA) office.

The SCO product is available to producers who elect and will enroll in the Price Loss Coverage (PLC) commodity crop program on a farm in 2020. With the ongoing election/enrollment in the ARC/PLC program this winter, the expectation of many experts is that most farmers will choose the PLC program on their corn base acres. However, the ARC-County (ARC-CO) program will be the choice for most soybean base acres.

The SCO band of coverage is based on the county revenue given that the underlying COMBO crop insurance product, likely Revenue Protection (RP) is also purchased. SCO provides a protection in a band at an 86% maximum level down to the coverage level selected for RP. An example would be a farmer who selects a 75% coverage level for RP and adds the SCO product. Thus, SCO could provide county-based revenue coverage from the 86% to the 75% level, or 11% total SCO.

To trigger an indemnity claim the actual county revenue must fall below 86% of the county revenue guarantee before SCO would trigger a payment. As a result, the RP-SCO combination provides mixed coverage: Farm-level coverage is provided from the RP product downward (65%, 70%, 75%, 80% and 85% levels) while county-level coverage provides between 86% and the coverage level of the RP product.

The primary disadvantage of the RP-SCO combination is that the county-level coverage may not match losses on a farm. Sometimes a farm may have a large revenue loss while SCO will not trigger a payment. It’s also possible that the farm does not have a loss while the county-based SCO product triggers a payment. Note that if an SCO indemnity payment is made, the farmer will not receive it until the June following harvest when USDA’s Risk Management Agency (RMA) releases the final county yields.

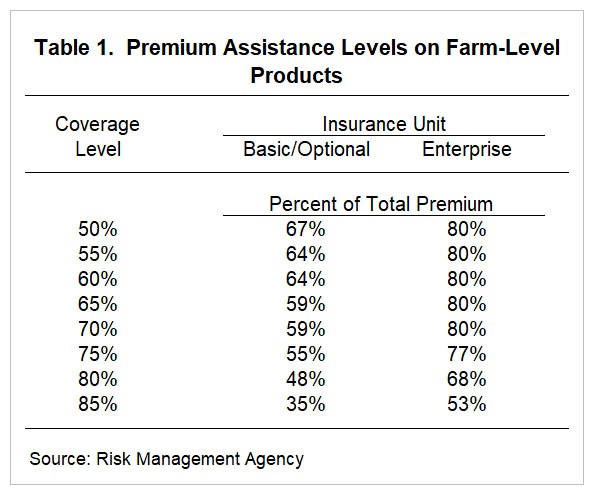

The primary advantage of purchasing an RP-SCO combination product is a lower overall farmer-paid premium. However, consider if your county yields are typically less variable than your farm’s yields. This could result in fewer indemnity claims for a county-based product than for that farm-level product at the same coverage level. SCO has a government subsidy rate of 65% which is higher than the rate for RP at the 85% coverage levels using enterprise units. This 65% subsidy rate is higher than all subsidy levels for basic and optional units when the coverage level is above 50%.

Farmers who typically purchase RP at high coverage levels (80% and 85%) will likely find a slightly lower farmer-paid premium by adding SCO. But consider a couple cautions before you add the SCO product in 2020. First, make sure your farm’s yields are reflecting your county’s yields. Second, if an SCO indemnity payment is triggered, don’t expect to receive those proceeds until the June following harvest.

Be aware of the time constraints that both FSA county office staff and crop insurance agents will have as this March 15, 2020 deadline approaches. Prepare now to elect and enroll in the ARC/PLC programs for your farms and perhaps update your PLC yields that will be effective for the 2020 crop. Then discuss with your agent the crop insurance changes you’ll be making in 2020 including the possibility of adding the SCO product if you will be enrolling in the PLC program for that crop.

An agricultural economics and business website.